SOME COMFORT FOR DC CONDO INVESTORS. Reading between the lines of the Washington Post story and the report by Delta Associates itself about condo prices, investors in metro DC condo market seem more likely to enjoy "a soft landing" than investors in other cities.

According to Delta, three characteristics are indicative of a hard landing:

- Low barriers to entry into the market and lots of housing production;

- Only modest levels of job growth;

- High levels of speculator activity;

Delta pointed to Las Vegas, Miami and Phoenix as "as cities to watch" for a hard landing. While metro-DC, Boston and L.A. are places where Delta "is more confident of a soft landing."

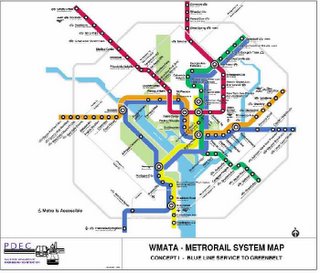

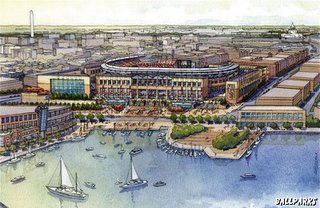

Looking at the three determinants, DC Bubble takes comfort in the strong job market in DC and the fact that absentee investors, as opposed to owner occupants, often are/were discouraged from buying condos on a pre-construction basis. Moreover, many hot DC areas (NOMA, Columbia Heights), as opposed to outside the Beltway, are incredible locations that for decades were underutilized and underdeveloped.

Always cause for comfort is the price of howeownership relative to income. For decades, the nation spent 3.5 times its income on a house. In many markets, this ratio is above 6, but "surprisingly, Washington and Chicago are affordable by this measure," Delta reported.

Delta goes on to say that prices have begun to fall not because of a glut, but because of "price fatigue. Buyers either can not afford or are not willing to pay these prices."