Well almost. The DC housing bubble has been discussed at length. But crime rates are a different story. Not since the mid-1980s will DC have endured/enjoyed two years in a row with less than 200 murders. As of Dec. 30, there have been 194 murders in DC compared with 195 for the same date last year when the total number for the year was 198. The last back-to-back years when there were fewer than 200 murders was in 1985 (147 murders) and 1986 (194 murders).

Not since the mid-1980s will DC have endured/enjoyed two years in a row with less than 200 murders. As of Dec. 30, there have been 194 murders in DC compared with 195 for the same date last year when the total number for the year was 198. The last back-to-back years when there were fewer than 200 murders was in 1985 (147 murders) and 1986 (194 murders).

Even better, DC is way off the high water mark when our city was declared "the murder capital." In 1991, there were 481 murders. In fact during each year of the 1989 to 1993 period, DC had over 400 murders annually.

Not surprisingly, the turn around in the DC real estate market also began around this time. Of course, one could argue rising prices were a national trend and DC was just part of it, but then again we could have missed out on the jump altogether. It seems like the two trends fed off of each other here in town. As crime fell, condos were developed and new neighborhoods (U street for instance) became safer and more attractive, which led to even lower crime rates and more development.

AND WHERE DID THAT CRIME GO? In contrast to the situation in DC, Prince George's County has experience a sharp increase in murders with 168 homicides in 2005 compared with 148 the same time last year. Fairfax also experienced a crime wave of its own as murder jumped from 11 to 22. Putting the violence into perspective, even as far back as 1960, DC (81 murders) had more murders then than Fairfax does today.

One Liners

Hoping to ward off a glut, condo and single-family home developers are offering incentives to potential homebuyers.

Three new supermarkets are slated to open in DC in 2006, says the Washington Times. Three stores are opening in the District -- Harris Teeter in Adams Morgan in the old skating rink and on Capitol Hill by the Potomac Avenue metro and a Giant in Van Ness. The timing and newness of these openings seems fuzzy to us.

With arbitration hanging over DC's head, DC and major league baseball met on Saturday, Dec. 31, to discuss ways to manage the cost of building the stadium. Under consideration are: selling development right within the stadium footprint, using a special WMATA fund to pay for metro renovations and getting MLB to kick in more free tix for city youth.

December 31, 2005

Another Year Of Fewer Crimes and Rising Housing Prices

Posted by

dcbubble.blogspot

at

9:29 PM

3

comments

![]()

Labels: Crime, marketplace

December 30, 2005

Morning Feed

COOLING, NOT MELTING: The "housing market is slowing" story is getting out ahead of itself. Reading all the real estate market slowdown stories makes it sound like prices are dropping and fast. Maybe prices are off thier highs of late summer, but they are nonetheless above year-ago levels. OK inventory is building -- look at all those lockboxes on condos around DC -- but so far prices are stable.

This assessment is underscored by the November Existing Sales report from the National Assn. of Realtors, which has the following headline: "Existing-home sales declined in November while home prices sustained double-digit annual gains."

According to the realtors, total existing-home sales in the South eased by 0.7 percent in Nov. 2005 to a level of 2.74 million, but were 3.8 percent higher than November 2004. The median price in the South was $184,000, up 8.2 percent from November 2004. Sounds pretty good to me. OK maybe not as good as things were a few months ago, but still pretty good.

MORTGAGE RATES DROP: NAR economist David Lereah pointed at higher mortgage interest rates as the culpriut responsible for moderating sales. Oh well, we guess he cant spot all those lockboxes and oversupply, at least here in DC. Thats not a factor, David? Is it! (Calm down.)

But dropping mortgage rates, which are now at a two-month low, should help. The 30-year fixed-rate mortgage averaged 6.22 percent, with an average 0.5 point, for the week ending December 29, 2005, down from last week's average of 6.26 percent, said Fredie Mac. Last year at this time, the 30-year averaged 5.81 percent.

The average for the 15-year this week is 5.76 percent, with an average 0.6 point, down from last week's average of 5.79 percent. A year ago, the 15-year FRM averaged 5.23 percent, said Freddie Mac.

One Liners

A 95 percent interest in the Warner Building at 1299 Pennsylvania Avenue NW has been acquired by Vornado Realty Trust for $170M in cash and the assumption of $149M in debt. Vornado says the 560,000 SF Warner Building is 93 percent leased but will not disclose the seller's name.

Manhole cover explodes and leaves apartment on Ga. Ave without power.

Posted by

dcbubble.blogspot

at

7:04 PM

1 comments

![]()

December 29, 2005

Afternoon Flash

DC is losing ground to Arlington and PG County, says Mayor Williams, who points to mixed use projects in those jurisdictions.

Williams believes a solution can be found to stadium lease impasse.

'Twas a few days before New Year's and the DC's murder rate is flat compared to last year.

Posted by

dcbubble.blogspot

at

1:48 PM

1 comments

![]()

Ain't It Grand

Word on the Street

The new Thomas Circle was supposed to be finished in January. Of course work on the project wont be done in time. But the restoration of DC's beloved Thomas Circle is such a great project, who cares how long it take to complete. The project to snatch the circle away from SUVs and return it to pedestrians is nearly complete. First G Street in front of the MLK library was reopened, now this. Maybe Pennsylvania Ave in Front of the White House will be opened too.

|  |

Circa 2004 | Circa 2006 |

"The restoration and redesign of Thomas Circle will act as a catalyst completing one more essential element in the revitalization of this historic district," said the press release touting the project. Now a pessimist will say the revitalized circle will give vagrants one more place to defile, but c'mon. Look at this picture. I wanna hangout there on a night this spring. And Im not even a bike messenger.

One Liners

Using a special fund to pay for Metro upgrades also is under consideration by the DC Council, including lease opponnet councilman Jim Graham. Sounds like the stadium/lease issue is not done cooking. Obviously its not a slam dunk, but no one is walking away and the issue continue to germinate.

DC touted various programs to help moderate and low-income people buy homes across the city.

Another story about the slowing housing market in DC.

Nordstroms is looking at opening a store in PG county.

Posted by

dcbubble.blogspot

at

9:28 AM

0

comments

![]()

Labels: Thomas Circle, transportation

December 28, 2005

Afternoon Flash

The DC Council wont vote on the baseball stadium lease until mid-January. The official deadline in the agreement between Major League Baseball and DC is Dec. 31. In addition to selling part of the stadium footprint to developers, other options are under discussion to offset cost overruns.

Posted by

dcbubble.blogspot

at

4:55 PM

1 comments

![]()

December 27, 2005

WORD ON THE STREET

HOLIDAY EXCHANGE: The replacement of the downtown  Hechts with Macys has been known since last year, but not the timing. Well the new signage is expected to go up in March, employees anonymously told us. Aside from the sign and a different merchandise mix not much else will change about the store, which was recently renovated and looks terrific. The merchandise at the store will be updated throughout the year leading up to Christmas 06. Expect fewer designer brands and more of the Macys' in house brands, we are told.

Hechts with Macys has been known since last year, but not the timing. Well the new signage is expected to go up in March, employees anonymously told us. Aside from the sign and a different merchandise mix not much else will change about the store, which was recently renovated and looks terrific. The merchandise at the store will be updated throughout the year leading up to Christmas 06. Expect fewer designer brands and more of the Macys' in house brands, we are told.

Many of the nervous employees fear they will lose their jobs after the switch because Macys' parent -- Federated which just bought the F Street store -- historically relies on less staff than the May Co. owner of Hechts.

STADIUM UPDATE

PROPERTY FOR SALE: The DC Council is considering selling development rights on land adjacent to the proposed baseball stadium to the Washington Nationals' new owner or development companies as a way to help cover potential cost overruns. Apparently the 15 acre stadium will consume only part of the 21 acre footprint. Oh maybe there is a way of out this mess.

ONE LINERS

Three leases signed for International Square for a total of 69,873 SF. Lawfirm Robin Kaplan Miller & Ciresi LLP signed on for 41,626 SF, the  American Association for Clinical Chemistry signed for 15,068 SF and Aptify, a provider of enterprise business applications and e-Business software, signed for 13,119 SF. No word on what they paid for the space.

American Association for Clinical Chemistry signed for 15,068 SF and Aptify, a provider of enterprise business applications and e-Business software, signed for 13,119 SF. No word on what they paid for the space.

DC Public Schools, Superintendent Clifford B. Janey will provide an assessment of DC public schools in January -- his budget proposal and textbook audit. Plus the DC Council votes on school modernization package.

Opponents of the planned Intercounty Connector say that the proposed tolls will make it too expensive for some drivers to use the highway slated for the D.C. suburbs as a daily commuting option. We say deep six the highway and build light rail instead.

Posted by

dcbubble.blogspot

at

7:40 PM

1 comments

![]()

December 26, 2005

Morning Feed

SALES DOWN, PRICES FLAT AS THE MARKET SLOOOWS: Reflecting a correcting DC real estate market, a DC realtors' market assessment shows that Nov. 2005 condo, co-op and single familiy home sales contracts were down 15% from Oct. 2005 in almost every price range. In response to growing concerns about "interest rates and the economy," Nov. 2005 sales were down 18% compared to the same period in 2004.

Not surprisingly, both single family and condos/co-ops experienced double-digit gains in inventory in Nov. 2005 and are 82% higher than this time a year ago. These inventory gains were even greater for homes and units priced over $300,000.

BUT PRICES ARE STABLE: Average sales prices for single family homes and condos/co-ops have increased by less than 1% since the end of the third quarter in Sept. and are 2% ahead of the second quarter in June.

Sales contracts for all single-family homes in Nov. 2005 fell 9% from Oct. 2005 and 18% from Nov. 2004. New contracts on condominiums and cooperatives in Nov. 2005 fell 21% from Sept. 2005 and posted the lowest monthly sales total of the year. The report was prepared for The Condo Connection, a DC real estate firm. ONE LINERS: Work has begun to restore the Old Naval Hospital at 921 Pennsylvania Ave. Friends of Old Naval say the need more $$$ to finish the job.

ONE LINERS: Work has begun to restore the Old Naval Hospital at 921 Pennsylvania Ave. Friends of Old Naval say the need more $$$ to finish the job.

The idea of building a light rail line in Anacostia gets a mixed review from the locals.

Someone at the Washington Post finally noticed that Metrobus gets little attention compared with Mertorail.

Proposed hospital in SE still is not a done deal. The fundamental issue when this comes before the DC council is: whether the hospital is for poor people or not.

Colin Powell, who wants a piece of the Nats, tells the DC Council to approve the stadium lease. We have no doubt that approval would be the right move. Comet Liquor in Adams Morgan on Columbia Road is closing. Goodbye Sid. Hello hair salon. Goodbye Challah. Can you say Bubbles? Maybe.

Comet Liquor in Adams Morgan on Columbia Road is closing. Goodbye Sid. Hello hair salon. Goodbye Challah. Can you say Bubbles? Maybe.

It's shame. The art-deco sign. The local flavor. All going away. This is what our nation is becoming. We dont like it. You probably dont either. But let's all face it. We are in the minority.

Posted by

dcbubble.blogspot

at

8:29 PM

6

comments

![]()

December 25, 2005

You Gotta Comment!?!

COOKING THE NUMBERS: It's true if a falsehood is repeated long enough, it becomes fact. It has been accepted -- by those for and against the new stadium in DC -- that the cost of the facility is $667M. But this estimate factors in many items  that should not in all fairness be counted. Instead of the $667M oft repeated price tag, a more accurate estimate comes in about 20% less at $557M.

that should not in all fairness be counted. Instead of the $667M oft repeated price tag, a more accurate estimate comes in about 20% less at $557M.

To overinflate the stadium's cost, opponents have unnecessarily added $110M to the price by incorrectly including:

--$30M in financing costs. (When most people buy a house or car, they dont add in the finance charges. You dont say: I paid $300,000 for a condo; put down $30,000, have a 30-year, $270,000 mortgage that will end up costing, say, $100,000 over the life of the loan, and then add $100,000 to the price for a total of $400,000. Wrong. If you dont do that with a condo or other property, don't do it with the DC baseball stadium.)

--$24 million to renovate RFK. (Whether the lease is approved or not this money was spent in early 2005.)--$3.5 million to build a grand plaza (Developers or the federal government, which pays for DC parks, ultimately will pay this bill.)

--$4 million to build some sidewalks around the stadium, (Same paid by developers or the federal government.)

--$1.5 million for DC to pay its own permitting fees. (The city pays the city and including this amount is double counting.)

--$12.9 million that Pepco is charging DC to pay for utility upgrades. (Ultimately developers will chip in or the cost will be spread out among all.)

--$21 million to improve the Metro. (Historically the feds pay for Metro.)

--$12 million to pave roads. (Again developers or the feds.)This cuts the cost of the stadium to a more manageable $557M.

WHO PAYS HOW MUCH? Borrowing $557M at a rate of 4.5% would create a mortage payment of $3.5M per month. The debt would be serviced by the $3.8M raised monthly by four sources of revenue:

--$1.2M per month ballpark fee, paid by 2,000 of DC's largest businesses,

--$1M per month tax, paid for primarily by the federal government and large businesses,

--$0.8M per month in ballpark taxes, assessed only on people who buy tickets, concessions, etc. (Mostly people from Virginia and Maryland, not DC)

--$0.8M per month in lease payments, paid by the Nats' owners. Theses taxes and fees almost entirely will be borne by institutions and those not living in DC. It should be Virginians and Marylanders who are up in arms not Washingtonians.

WHAT ABOUT PRIVATE FINANCING? The interest rate would rise from 4.5% to 5.5%, and the monthly payment would rise from $3.5M to $3.8M. The whole thing becomes harder to pull off for no reason. Like so many stadiums, including Camden Yards, the public financing is the smart way to go. Again we urge the DC Council to approve the lease.

ONE LINER: It's schools vs. yups as another developer has moved into Southeast by purchasing 770 M Street SE for $20M. Preferred Real Estate Investments Inc. says the location of the 100,000SF building makes it ideal for retail stores such as a Barnes & Noble bookstore or a Whole Foods grocery. Three charter schools currently call the building home.

Posted by

dcbubble.blogspot

at

10:40 PM

8

comments

![]()

December 24, 2005

Weekend Roundup

BLINDNESS AT THE CENSUS DEPT: DC population fell by 3,718 to 554,239 over the past year. Maybe those folks over at the US Census Bureau should look out their windows to see all the baby strollers on Capitol Hill and elsewhere in DC. Wait they cant see the little ones becaue their view is blocked by all the new condos. Wait Census is located in Suitland, Md, so what do they know? This cant be right.

Now This Is More Like It: Leadership Void Keeps Stadium Deal Up in the Air, says analysis from the Washington Post. Yesterday, we said something very similar. We guess we will have to take back our assertion that the post is "naive." You know the void -- the leadership void -- has gotten pretty wide if Sir Marion Barry gets to assert his voice counts.

SALE ON K STREET: Starwood Capital Group reached a deal to sell the 563,800-SF office building at 1801 K St. for $250M to NYC's Somerset Partners, says the CoStar Group. The deal works out to about $443 per SF.

GOODBYE AFFORADABLE HOUSING: Some D.C. Apartment Rents Found to Exceed Caps, says the Washington Post.

NO PROGRESS ON LEASE. D.C.: Officials have so far failed to persuade developers and the federal government to chip in for a new ballpark for the Nats, says the Washington Times. As for the very expensive Metro upgrades, a DC official said no one from the White House "has said 'no way,' and we consider that progress" on the question of whether the feds will kick in for rail, the Times of DC reported.

Posted by

dcbubble.blogspot

at

9:36 AM

1 comments

![]()

December 23, 2005

You Gotta Comment!?!

PLAY BALL, NOT CHICKEN, the Washington Post says about the potentially greatest real estate deal in the city's history. While my heart is with the editorial writers at the WP, they strike me as being incredible naive and unhelpful.

Isn't playing chicken part of playing ball? Business negotiations over real estate or whatever often crumble or are consumated based on the Yogi-ism "It ain't over til its over." Congress, in fact, operates this way. Hellooooo ... Washington Post. The editorial goes on to say MLB "should not stand in the way or seek to discourage prospective team owners who wish to discuss constructive ways to handle building costs." As discussed earlier, this scheme will lower the price of the Nats. So it should be no surprise that MLB resists letting the city make a deal. Baseball owners are sharks with the sharpest teeth, remember.

C'mon put wishful thinking aside, Washington Post. Someone powerful should make a real case for the stadium (i.e. job creation, revenue generation, fun!!, baseball will make a bundle in D.C.) or the Nats will go away. The high ground won't cut it in this case, maybe its time for the Post to really start placing blame and point its finger at the man who runs this town (not George W.).

Posted by

dcbubble.blogspot

at

8:25 AM

2

comments

![]()

Morning Feed

MORTGAGE RATES FLAT LINE: The benchmark 30-year fixed-rate mortgage fell one basis point to 6.33 percent this past week, according to the Bankrate.com national survey. One year ago, the mortgage index was 5.75 percent, and four weeks ago it was 6.32 percent. The benchmark 15-year fixed-rate mortgage fell 1 basis point, to 5.91 percent.

Fed rate hikes nearing an end says David Wessel of the Wall Street Journal. After Sir Alan Greenspan calls it quits on Feb 1., newbie Ben Bernanke's first move (Wessel is not saying when) will be to lower rates. This would mean only one more quarter point hike before Greenspan says "hasta la vista."

Posted by

dcbubble.blogspot

at

8:15 AM

1 comments

![]()

Morning Feed

FASTER THAN YOU CAN SAY HOTEL HARRINGTON:  Inexpensive hotels are disappearing from downtown, reports the Washington Examiner. The hipper-than-thou Klimpton Hotels drove Ramada, Quality Inn and other middle-tier hotels out of DC, says the paper.

Inexpensive hotels are disappearing from downtown, reports the Washington Examiner. The hipper-than-thou Klimpton Hotels drove Ramada, Quality Inn and other middle-tier hotels out of DC, says the paper.

You often see families and tour groups riding Metro out to the end of line somewhere because they dont want to spend the bucks to stay in a Washington hotel. Another sign that DC is becoming a prosperous place. This is a good thing, we suppose. We sure wish there was a way to upgrade and keep things relatively modestly priced, but that does not happen in America anymore.

Posted by

dcbubble.blogspot

at

8:03 AM

1 comments

![]()

December 22, 2005

Morning Feed

NO STADIUM, NO COMMUNITY DEVELOPMENT FUND. At risk is up to $125 million for school construction and modernization, $45 million for improving public libraries, $10 million for plans to build a new hospital and $2 million for supplies at McKinley Technology High School in Northeast, says the Washington Times. D.C. officials say those projects would be in doubt if the $667 million stadium project doesn't move ahead as planned.

COMING TO WALTER REED HOSPITAL: A federal agency, not private development, i.e. condos, restaurants, hotels? GSA has expressed interest in the 113-acre campus, set to close in 2010, says the Washington Examiner. Applications to redevelop the site on Georgia Ave. are due by Jan. 16 and federal government has first dibs.

BRUHAHA IN PETWORTH over condo conversion, says the WE. The fight over 809-811 Otis Place NW is like the epic battle over Sursam Corda only in minature.

DON'T PROMISE TO PAY D.C. for stadium upgrades MLB tells potentional owners of the Nats because...because...well because that might lower the price that we get for selling the team. Washington Post says Nats Bidders Told Not to Offer Funds as MLB tries to thwart private deals. This supposedly is what Marion Barry was working.

Posted by

dcbubble.blogspot

at

6:41 AM

1 comments

![]()

December 21, 2005

You Gotta Comment?!?

Remember the Wig Shops? Downtown used to be a dark and dreary place. Before 1997  there were no movie theaters or a bowling Alley. Very little shopping. Only a handful of swanky restaurants and hotels. Almost no condos. Now, almost ten years later, we have a vibrant and lively center.

there were no movie theaters or a bowling Alley. Very little shopping. Only a handful of swanky restaurants and hotels. Almost no condos. Now, almost ten years later, we have a vibrant and lively center.

Would it have happened without the MCI Center, which opened on Dec. 2, 1997? We say: Yes and No. Downtown would have developed (it's still very much a work in progress.) But it would have taken much more time. We also doubt whether the entertainment component would have

been part of the mix. More than just sparking economic

growth, the arena helped prevent downtown from emtying after 6 pm.

What do you think? What would F Street look like in 2006 without the MCI Center? And what does this tell us about the proposed baseball stadium along the Anacostia?

Photo by jjthomas

Posted by

dcbubble.blogspot

at

6:53 PM

3

comments

![]()

Flash

A Day Late (and a Dollar Short?): The D.C. Government has a website extolling the business and employment benefits of the stadium. I suppose the case for a stadium would have been stronger if this was available before the scheduled vote on the lease, but maybe it was Marion Barry's idea. And no one cared what he thought until he took credit for delaying the vote. ... Get your Panda tix here. 29,000 have been released.

Posted by

dcbubble.blogspot

at

2:06 PM

1 comments

![]()

Morning Feed

Barry Is Still Mayor-For-Life: Reporting that Councilman Marion  Barry Moved to Block Stadium, the Post says the ex-mayor claimed credit for rallying a majority of the council to block the mayor's ballpark plans. “To some on the council, Barry seemed to be exhibiting more leadership than Williams or council Chairman Linda Cropp,” said the Post. Uhhh. Hmm. You know, they may be soothsayers at the Post. Ouch. Ouch. Ouch. The truth hurts. The Examiner has this to say.

Barry Moved to Block Stadium, the Post says the ex-mayor claimed credit for rallying a majority of the council to block the mayor's ballpark plans. “To some on the council, Barry seemed to be exhibiting more leadership than Williams or council Chairman Linda Cropp,” said the Post. Uhhh. Hmm. You know, they may be soothsayers at the Post. Ouch. Ouch. Ouch. The truth hurts. The Examiner has this to say.

Nowww you tell me! The Washington Post warns Borrower Beware: Interest Only. ARM Rates are rising and some homeowners are worried they may lose their houses. Yikes. Our sympathies.…Housing start fell slightly, 1.3 percent, in the South, which includes the Washington area, says the Post. ... Bill to dedicate sales tax revenue to fund Metro was introduced in D.C.

Posted by

dcbubble.blogspot

at

8:51 AM

1 comments

![]()

December 20, 2005

MLB says the city will be in default as the lease is pulled from the DC Council. So much for all the hard work to improve the credibility of our local government. I feel like my homeroom teacher who said something like: Independence equals responsiblity. DCBubble's letter to the council is posted here.

Posted by

dcbubble.blogspot

at

4:52 PM

1 comments

![]()

Morning Feed

Music Venue To Be Added to Downtown Mix: A music education group,  the Gig, is about to sign a lease for the old Carnegie Library site at Mount Vernon square, according to the Post's Mark Fisher, who says A D.C. Music Museum Sounds Better and Better for downtown. As far as we can tell, the Gig is a hands on musical venue. To give us a taste of what they are about, the Gig is holding a "Multicultural Celebration" Dec. 26 and 27. ....Fisher also reports that MLB is almost ready to start seeking bids from other cities for the Nats. Is DC again trying show the nation/the world how provincial we really are? D.C. Council please figure this out.

the Gig, is about to sign a lease for the old Carnegie Library site at Mount Vernon square, according to the Post's Mark Fisher, who says A D.C. Music Museum Sounds Better and Better for downtown. As far as we can tell, the Gig is a hands on musical venue. To give us a taste of what they are about, the Gig is holding a "Multicultural Celebration" Dec. 26 and 27. ....Fisher also reports that MLB is almost ready to start seeking bids from other cities for the Nats. Is DC again trying show the nation/the world how provincial we really are? D.C. Council please figure this out.

The Examiner reports on yesterday's hearings on the proposal to close some D.C. public schools and sell the property to charter schools or someone else. Excess property has been plauging the D.C. school system for decades and Public Schools Superintendent Clifford B. Janey hopes/plans/expects to close as many as one-third of D.C. schools next year. But the controversy surrounding this first round of closures shows he should be prepared for a big fight.

Posted by

dcbubble.blogspot

at

7:38 AM

3

comments

![]()

December 19, 2005

Vote on Stadium Lease Postponed. This soap opera is gonna give me a headache. MLB must realize the value of having a team in DC and the DC council should recognize the economic benefits of the stadium. Can't we all just get along? There must be a compromise out there.

Posted by

dcbubble.blogspot

at

7:06 PM

2

comments

![]()

You Gotta Comment?!?

A proposal to dispose of old public school buildings was the subject of a hearing today at the DC Council's Committee on Government Operations. The four buildings in question are the Bruce School, located at 770 Kenyon Street, N.W., Old Congress Heights School, located at 600 Alabama Avenue, S.E., the Langston and Slater Schools, located at 33 and 45 P Street, N.W., Washington, D.C., the Keene School, located at 33 Riggs Road, N.E.

Under the proposal, charter schools would given preferential rights to purchase, but some community activits, say they should have first say in what is done with the properties, according to WAMU.

Used to be a school, now someone wants to build a school on the sites, seems like a no brainer? But shouldn't the locals have a say in this? What if they dont want a school or see some better use for the property? Condos? Community Center? Casino gambling? (kidding)

Posted by

dcbubble.blogspot

at

2:55 PM

3

comments

![]()

Morning Update

It Used To Be No Man's Land: But now H street  Northeast is a hot spot with Louis Dreyfus Property Group planning a retail and residential called Capitol Place, to be located between Second and Third and G and H streets NE, Washington Business Journal reports. The project features 55,000 sf of retail and 305 condos. Its across the street from Abdo's children's museum project. Papers are on file.

Northeast is a hot spot with Louis Dreyfus Property Group planning a retail and residential called Capitol Place, to be located between Second and Third and G and H streets NE, Washington Business Journal reports. The project features 55,000 sf of retail and 305 condos. Its across the street from Abdo's children's museum project. Papers are on file.

Closing costs on a $180,000 loan in DC are about $100 more than the national average, says Bankrate. ...Michael Stevens will leave his job next month as chief executive of the Washington DC Economic Partnership, which markets DC to businesses and developers, said the WP's From the Ground Up. ...WMATA is preparing for a possible "yes" vote on the stadium lease, while Rep. Tom Davis advocates for approval of the lease, says WJLA. ...The Washington Times says restaurant sales are expected to increase 5.4 percent in DC in 2006, according to the National Restaurant Association.

Posted by

dcbubble.blogspot

at

7:44 AM

2

comments

![]()

December 18, 2005

Morning Update

With the DC Council set to vote on Tuesday, the WP editorialized on "The Stadium Lease Deal," saying "Our view, though, is that if the District cannot improve its position between now and Tuesday, the council should approve the lease and expect the city to arrange a better sharing of costs and risks with the new owners once the team is sold....The WP also reported that Williams, Cropp Push To Tweak Stadium Lease. We're talking minor clarfications here. Sounds like Tony and Linda are working hard to twist arms. Anyone wanna lay down odds on whether or not the vote actually happens on Tuesday?...Took a cab with my wife from downtown to Georgetown last night. 12 bucks. Took the K street "red bus" that runs along K street back to 16 & K streets, $2.00. Its a great bus if you have not tried it. Runs late. Runs early and makes Georgetown accessible....Pro and anti-stadium rallies set for Monday.

Posted by

dcbubble.blogspot

at

11:07 AM

2

comments

![]()

December 17, 2005

Open Letter To Council Members Adrian Fenty, David Catania, Marion Barry, Jim Graham, Carol Schwartz, Phil Mendelson, Linda Cropp, Vincent Gray and Kwame Brown.

To Council Members Adrian Fenty, David Catania, Marion Barry, Jim Graham, Carol Schwartz, Phil Mendelson, Linda Cropp, Vincent Gray and Kwame Brown.

The debate over the stadium in Southeast has focused almost exclusively on construction costs. How much and who should pay?

The debate has failed to fully recognize the economic and tax revenue boost from the stadium. Each night fans will spend hundreds of thousands of dollars which over the course of the season will translate into hundreds of millions in additioal tax revenue. One NBA playoff game, for instance, generated $100,000 in sales tax revenue, according to the Washington Examiner. Remember 82 home baseball games are played each year (plus playoffs, god willing).

Similarly, the additional real estate development -- condos, retail, offices -- will contribute millions to the D.C. tax base. Developers say over $100 million in tax revenue will be generated.

The objection to the use of public funds amounts to nothing more than political grandstanding. The debt on the bonds will be serviced by patrons of the stadium through ticket sales etc. While many of those patrons will be from D.C., most will be from the Maryland and Virginia suburbs.

Additional stadium tax revenues could be used to improve schools, fund other benefit programs or lower taxes. Vote "yes" for the site in Southeast along the Anacostia.

Posted by

dcbubble.blogspot

at

9:08 AM

8

comments

![]()

Morning Feed

With Evans Out of Mayor Race, DC Bubble Endorses Rep. Tom Davis, R-Va., in the mayor's race for 2006 or even 2010. Ok. He probably does not want the job and probably never has strayed too far from Capitol Hill.

But Davis claimed on WTOP that he is making headway in the homerule fight. Rep. Davis Cites Fresh Interest in D.C. Voting Rights, Including From Bush, the WP report. His somewhat controverial plan for expanding the House to accommodate the District's representative has 18 co-sponsors, similarly reported the WE...WP also reports that Improved Web Tools Make Virtual Renting Seem Less Remote but fails to mention sources for D.C. rentals like Rent.com, apartments.com or craigslist. Duh...Opening soon on F Street opposite, the H&M store, is streetsmart American Apperal.

Posted by

dcbubble.blogspot

at

8:51 AM

3

comments

![]()

December 16, 2005

You Gotta Comment?!?

"Go Ahead and Call It a Comeback:" says columnist Harry Jaffe  in the WE where he declares downtown the "hippest, hottest place in D.C." Move over, Georgetown, Adams Morgan, Capitol Hill, Dupont Circle, the New U, Jaffee says.

in the WE where he declares downtown the "hippest, hottest place in D.C." Move over, Georgetown, Adams Morgan, Capitol Hill, Dupont Circle, the New U, Jaffee says.

Metro converges Downtown. It's close to the Capitol and the White House. I always believed that the wig shops on 9th St. were the anomoly and that someday, somehow old Downtown would be D.C.'s focal point.

Has 7th St. eclipsed Wisconsin and M Streets? Or Tysons? Where does one have to stand to be at the center of DC? Washington? The Metro Area?

Posted by

dcbubble.blogspot

at

9:02 AM

11

comments

![]()

Morning Feed

New Parking Meters: DC is seeking to replace 9,000 aging meters with 900 multispace, solar-powered machines - the same technology now installed along M Street in Georgetown, say the WE. Some complain about multi-space meters, but I think they are efficient and kinda cool. Anything to imporve the streetscape should help make city life more attractive. ...Eight cars trains coming to Orange Line...Lots of lobbying on the baseball lease, says NBC4. ...Mortgage rates slip a bit, says Freddie Mac .

Posted by

dcbubble.blogspot

at

8:17 AM

1 comments

![]()

December 15, 2005

From the Northwest Current

Old Bar, New Bar, Monkey Bar: Trio's on 17th St. wants to use its R St. outdoor space to serve liquor. I find this to be shocking...shocking I tell you. Well, they also want to stay open until 3 a.m. on weekends outdoors and even I have to admitt this is late....Tonic is opening on the campus of GWU...Making Glover Park even more family friendly Stoddert Elementary is winning support for a recreation center....Cue Bar at 1115 U St. NW is open and further signals the neighborhood revitalization. It's brought to you by the folks from Georgetown Bar & Billiards

Posted by

dcbubble.blogspot

at

2:18 PM

3

comments

![]()

Morning Feed

GalleryPlace is Coming to Life: More and more retailers opening. Finally, Lucky Strike, the retro bowling alley, and the Clyde's are open after almost two years of construction. When I asked a manger of Clyde's about the delay, he said "What do you expect, it's a union town." Based on that response, I am sure glad I will be a diner at Clyde's and not a worker. Bed, Bath and Beyond is advertising for workers so they must be pretty close to opening too. And Balducci's is planning a store on 7th St. Dont get me wrong, a grocery store is a great thing and this is good for the nacsent "Penn Quarter" 'hood. Nevertheless, I will never forget the one time I went to Balducci's in Bethesda with a friend who purchased a bottle of modest wine, some cheese and few grapes and the bill came in over $100. Yikes..... Mark Fisher from the says Some on The Council Are Trying To Cover All the Bases and gives a head count for the DC council on the stadium...The WE explores how the proposed stadium will spur development in Anacostia...D.C. Council's Phil Mendelson Honored As Regional Leader of the Year by the Metropolitan Washington Council of Governments. Go Phil!...The WP reports that a "Planning Body Foresees Housing Shortfall". Metropolitan Washington Council of Governments says Fairfax and Montgomery will need to change housing policies. I guess all those low-rises and open space in DC dont warrant a comment from COG according to the WP.

Posted by

dcbubble.blogspot

at

7:44 AM

1 comments

![]()

December 14, 2005

Afternoon Feed

Orange Gives Green Light: D.C. Councilman Vincent Orange says an entertainment district around the proposed stadium site is an opportunity for Washington. DC Bubble presumes that when Orange says entertainment he means a wholesome, Las Vegas-style district and is not referring to nightclubs like Wet and Edge that currently entertain visitors to the area. Orange has been a supporter of the project and is not one of the undecided council members....Uhhhhh. Now I'm optimistic says Tony Williams about a stadium lease winning support in the DC Council.

Posted by

dcbubble.blogspot

at

3:31 PM

0

comments

![]()

You Gotta Comment?!?

Yet Another DC vs. New York Comparison: (It drives me crazy the way the Washington Post every few weeks will compare Washington to NYC. The stories fallow a few different themes: 1. DC is filled with bumpkins, Manhattanites are cool because.... 2. A new shop, restaurant etc. has opened here and we are now becoming so cool that we are like NY... 3. It's so weird up in NYC because people are doing the following... ) Ok here is another comparison. With regard to real estate, in New York, the chicken follows the egg; But in DC, the egg follows the chicken.

Ok here is another comparison. With regard to real estate, in New York, the chicken follows the egg; But in DC, the egg follows the chicken.

Let me explain. In New York city, neighborhoods often get revitalized, trendified when a new restraurant or nightclub opens. Once the public percieves the area as exciting and "up and coming" as signified by some hot cuban-chinese fusion place, then new people start to live there.

Here in D.C. The opposite seems to be true. Only after the neighborhood has been established do the restaurants follow. Why is that? Crime is one reason. The most isolated neighborhoods in DC often are the most crime ridden. Murderers and drug dealers don't encourage entrepenuers to seek out a neighborhood. Once the market is established by condos, only then do restaurants etc. open.

Furthermore, Washingtonians generally are not an adveturous bunch. In DC something becomes trendy when everyone is doing it. For years, U Street was perceived as dangerous and scary. Now U Street is "trendy" because houses sell for up to $1m. And only of late have "high-end" restaurants begun to open, i.e. Creme, Al Crostini etc.

Wrapping this up, a hot restaurant in NYC might signal a neighborhood where real estate prices are low, but in Washington it might signal an over appreciated real estate market.

Posted by

dcbubble.blogspot

at

1:03 PM

3

comments

![]()

- Morning Feed

Free-Market Capitalists at Work at 14th and W: The WP outlines how low-income latinos and african americans fought "the man" and made the purchase of a lifetime. Something tells me that the poor and downtrodden are not longer so poor and downtrodden. WP graph showing other efforts around town where tenants are buying their properites...Baseball lays down the guantlet in the Moonie Times...Rates on 30 year fixed mortgages rise .03% to an average of 6.39%, according to bankrate.com...Dozens of retailers send letters of interest in area surronding SE site, says WE.

Posted by

dcbubble.blogspot

at

7:35 AM

1 comments

![]()

December 13, 2005

MLB now says SE site or deal is off. Plus for some reason Ralph Nadar is chiming in to say "A 'no' vote will potentially save taxpayers hundreds of millions of dollars." Will someone wake the mayor up and remind him that his legacy is at stake?

Posted by

dcbubble.blogspot

at

8:13 PM

1 comments

![]()

Stadium Math Opponents of the baseball stadium in Southeast have conviced some that locating the stadium at RFK would save a bundle.

Opponents of the baseball stadium in Southeast have conviced some that locating the stadium at RFK would save a bundle.

Well the price difference between locating the stadium in Southeast and at RFK is a whopping $67 million, according to CFO Natwar M. Gandhi. The WP says the Stadium Price Tag Rises by Millions to $605M at SE.

But tax revenue generated by a Southeast location over the life of the stadium would be 10, 20, 30 times that amount. How many jobs is that, Nat? C'mon Tony Williams lets get some figures out there showing the benefits of the stadium in SE. Construction jobs, bar and restaurant jobs. Lawyering jobs.

Here is what Tony had to say at today's hearing. Afterward he admitted, the lease will be "an uphill battle" in the Council. Master of the obvious he is.

Posted by

dcbubble.blogspot

at

10:49 AM

0

comments

![]()

December 12, 2005

Wake Up Tony or You Wont Get The Stadium Where You Want It

The developers in Southeast are saying if you build the waterfront stadium, they will come. Rather supporters of the stadium in Southeast should be saying Tony Williams, too little, too late. Tony should have been selling and selling his favorite spot for the stadium for months. How many more jobs from the Southeast location? Tax Revenues?

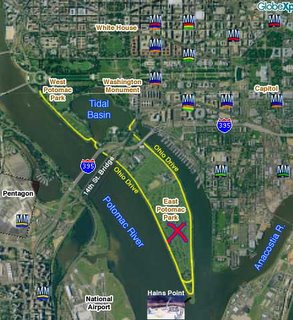

According to the Washington Post in Developers Named to Rebuild Anacostia Waterfront, Williams said the city "sent a message asking, 'Does anyone want to build around the ballpark?' The answer was, 'Yes, we are interested in bringing real economic development.'" This map show who owns development rights where near the stadium.

Latest Head Count from the Washington Examiner:

Likely yes: Evans and Council Members Sharon Ambrose, Kathy Patterson and Vincent Orange.

Likely no: Council Members Adrian Fenty, David Catania, Marion Barry, Jim Graham, Carol Schwartz and Phil Mendelson.

Unknown: Council Chairman Linda Cropp (last year's swing vote) and Council Members Vincent Gray and Kwame Brown.

Posted by

dcbubble.blogspot

at

7:00 PM

0

comments

![]()

Convention Center: East vs. West

While the convention center spurred development along the west side of the convention center, things have been moving much slower along the east side. But the Washington Post reports that efforts to build a convention hotel along Massachusetts Ave. are moving along. Yikes! Another Marriot....The Fed is expected to raise the prime rate from 4% to 4.25% this week. Most expect one more quarter percent hike and then who knows?

Posted by

dcbubble.blogspot

at

10:00 AM

0

comments

![]()

December 11, 2005

December 10, 2005

Idea: Turn the Park into A Park I have always marveled at the amount of unused public space in DC compared to other cities, i.e. New York. Some call these spaces "parks," but they really are not because to my mind a park is place to hang out, play or run around if you are a kid or dog. But only a few run around say the area along M street by the Georgetown bridge or East Potomac Park, south of the Jefferson Memorial.

I have always marveled at the amount of unused public space in DC compared to other cities, i.e. New York. Some call these spaces "parks," but they really are not because to my mind a park is place to hang out, play or run around if you are a kid or dog. But only a few run around say the area along M street by the Georgetown bridge or East Potomac Park, south of the Jefferson Memorial.

Well a recent forum sponsored by the Corcoran Gallery examined what to do with East Potomac Park. According to the Washington Post, architects and designers "were giddy with the possibilities." They talked about giant sculptural bridges, soaring waterfront museums, inland canals, water taxis and monuments that would forever change the nation's capital. Architect Arthur Cottom Moore discussed moving the Supreme Court buiding to the site.

I always have been amazed by the size of the space and the fact that the park is so underutilized. Riding the Yellow Line, I often thought there should be a Metro stop there, but then realized there would be no where for riders to go. Why not put some commerical, government or cultural activitiy to the space? For that matter, why not turn the park into a park by building atheletic facilities (aside from golf), an area for concerts or even landscaped gardens. Hopefully, the forum will get things moving.

Posted by

dcbubble.blogspot

at

9:25 PM

3

comments

![]()

December 9, 2005

A Jouney of A 1,000 Miles Begins with the First Step AP reports that Chairman Tony Williams' has reached a lease deal with MLB on a stadium in Southwest. Could the mayor's 1,000 mile journey be near its end? Of course the D.C. Council must vote Dec. 20, so stay tuned and Tony keep those walking shoes handy because as Chairman Mao famously said "it ain't over 'til it's over."

AP reports that Chairman Tony Williams' has reached a lease deal with MLB on a stadium in Southwest. Could the mayor's 1,000 mile journey be near its end? Of course the D.C. Council must vote Dec. 20, so stay tuned and Tony keep those walking shoes handy because as Chairman Mao famously said "it ain't over 'til it's over."

Posted by

dcbubble.blogspot

at

9:08 PM

0

comments

![]()

December 7, 2005

Latest from the December 7 Current Newspaper

The blood fued between the Dupont Circle ANC and the developers of 1616 Rhode Island Ave. continued as the Board of Zoning Adjusment asked the developer to downsize its proposed office building...."There goes the neighborhood" because Johnny Rockets has leased spaced at 1718 Connecticut Ave. Johnny & Co. took a spot from Quiznos...The size of a loading dock appears to be holding up the movement of Harris Teeter into the Adams Morgan neighborhood. Opponents of the project fear noise and congestion in Adams Morgan, which already is a vibrant and energenic community. Won't the store only make the neighborhood more like it is now? C'mon this ain't Centerville.

Posted by

dcbubble.blogspot

at

2:59 PM

0

comments

![]()

December 2, 2005

Pulling The Rug From Under the Developers

Pity the poor investors who bought land in Southwest thinking DC would build a baseball stadium down there. They must be newbies to this town to believe that the stadium would be built where the DC govt said it would be built.

My only question to Councilman David A. Catania, who according to the Washington Post supports this idea, is: will this ultimate bait-and-switch chill future investment in DC? To save $20m, $30m or $40m, won't the city lose out on billions in future investment? If I had millions to spend, which I dont, I would think twice about investing here given the headaches, sleepless nights and fretting one has to do to do to conduct business.

Posted by

dcbubble.blogspot

at

10:38 AM

0

comments

![]()

December 1, 2005

More None News From the Washington Post

Leave it to the Washington Post to call it news that some people can't afford to buy a house in the neighborhood they want to. Puleez. I, for instance, would love a five bedroom house in Kalorama, but cant afford it. Wait don't I have some sort of right to pay what-I-can just because I have lived in D.C. for 25 years? That makes me a native, right?!?

As for the poor librarian who the WP says "lacks the means to purchase something she likes on the open market," I say boo-hoo. Maybe she should look at a studio or one bedroom apartment, rather than the house in Silver Spring she is pictured looking at.

Posted by

dcbubble.blogspot

at

9:52 PM

0

comments

![]()

How Cold Is It? O.K., WDC condo, co-op and single-family home sales market is cooling. But is it: frosty? chilly? luke-warm?

O.K., WDC condo, co-op and single-family home sales market is cooling. But is it: frosty? chilly? luke-warm?

The extent of the slowdown "became much clearer in October," say a local reators' report. Although total sales of single-family homes and condominium and cooperative units increased by 10% from September – as should be expected since October is traditionally the best sales month of the fall season – they were off by 7% from October of 2004, 11% from 2003 and 6% from 2002.

Sales of condo and co-op units priced over $300,000 continued to make strong gains in October, as they have throughout the year, but single-family sales in many price ranges did not keep pace. At the end of June, half way through 2005, overall residential sales were running 3% ahead of those in 2004 but by the end of October they were down to a virtually even level.

This is certainly not the result of a shortage in properties for sale since the inventory of both homes and units has increased substantially in the last two months and is higher now than it has been since the late 1990’s. But concerns about the economy and interest rates have resulted in buyers exercising much great caution this fall than was evident in the spring.

Posted by

dcbubble.blogspot

at

10:38 AM

0

comments

![]()

November 20, 2005

D.C. Growth Continues

The revitalization of WDC is an ongoing process, reports the Fannie Mae Foundation. While the suburbs still account for most of the region’s sprawling growth, the District’s revitalization

continues to gain strength. City employment reached 672,000 in 2004, up from 650,000 in 2000, and the number of households choosing to live in the District is climbing, noted the Fannie Mae's recent report, Housing in the Nation's Capitol.

But the corresponding real estate boom has not impacted the city uniformly. Some neighborhoods — Mt. Pleasant and Capitol Hill, for example — "are under intense market pressures," said the recent report. Others — including Deanwood and Congress Heights — remain weak. As a result, affordable housing is disappearing and concentrating poverty in lower-cost neighborhoods.

To achieve a more equitable distribution of the benefits that prosperity creates, the WDC "will need to ensure that more affordable housing choices are available throughout

the city."

Posted by

dcbubble.blogspot

at

4:34 PM

2

comments

![]()

November 18, 2005

Luckiest Man of the Face of the Earth

Luckiest Man of the Face of the Earth

No not Lou Gehrig, but Duane R. Deason who bought half an acre near Buzzards Point and months later learned the new baseball stadium will be his neighbor. The 38-year-old accountant bought the land for $275,000 and is about to sell it for $8.3 million, according to the Washington Post. That's a 3,000% return on equity. Deason tells the Post: "I got kinda lucky." Uh huh.

Posted by

dcbubble.blogspot

at

8:39 AM

0

comments

![]()

August 14, 2005

Perspective From the Number Crunchers

Perspective From the Number Crunchers

The risk that home values in D.C. and its ever expanding ring of suburbs increased slightly over the last several weeks, say the number crunchers at PMI Group, which provides mortgage insurance on many loans. Its latest report, Economic and Real Estate Trends (ERET) from August declares there is a 20.9% chance the local market will fall in the next two years. The May ERET report showed only a 18.7 % chance the market would drop.

Considering the recent runups, a 20% or so chance that the market will drop in the next two years lets me rest easy at night. First, this means that there is an 80% chance that the huge gains the lucky ones have enjoyed will not disappear and may even grow.

Second, D.C. and its 'burbs are a heaven for the faint at heart considering that places like Boston, San Diego, Nassau County, NY, have a greater than 50% chance of losing value in the next two years. This statistic only restates one of the truisms of living in the District, the Commonwealth and Merland: our economy is relatively stable. While the stock makert and high-tech mania produce lots and lots of overnight millionaires, our frumpy, but stable, economic base means we don't soar as high as other regions and don't plunge as deeply when things to sour.

Posted by

dcbubble.blogspot

at

11:31 AM

1 comments

![]()

August 5, 2005

Further Signs of Chill in the Outer Suburbs

Robert Toll, chairman and chief executive of Toll Brothers, during a conference call Aug. 3 with analysts, said "we do see cooling in some local markets that were red hot a few months ago." Specically demand for McMansions in Las Vegas, New Jersey and the Washington D.C. area have relaxed a bit. Orders for luxury homes that sold in a matter of days or hours now take a couple of weeks, he said.

Posted by

dcbubble.blogspot

at

8:52 AM

0

comments

![]()

Labels: the market

August 3, 2005

Stadium Turning More Porny SE Into Gold

Two parcels of land -- located about three blocks north of the proposed baseball stadium site in Southeast -- have been purchased by JPI, a Texas-based residential builder. One parcel at 900 First Street SE, now a strip club, is "likely to close," helpfully reports the Washington Post. The other property is on I Street between South Capitol Street and New Jersey Avenue SE.

JPI also is developing the newly constructed Lafayette Condo in Penn Quarter and Jenkins Row on Capital Hill, as well as various properties in the Commonwealth of Virginai and Merland.

Posted by

dcbubble.blogspot

at

8:27 AM

0

comments

![]()

Labels: Baseball Stadium, Southeast

August 1, 2005

A Rose Is A Rose

Whether the sole department store downtown is called Hecht's, Macy's or Bloomindale's could make a big difference in how and when retail reemerges at Metro Center.

Whether the sole department store downtown is called Hecht's, Macy's or Bloomindale's could make a big difference in how and when retail reemerges at Metro Center.

You see Federated Department Stores Inc., which owns Hecht's wants to do away with the Balt0-D.C. brand. Considering hoopla surrounding Bloomies and Macy's on Federated's webside and how little attention Hecht's gets (none!) , it is should come as no surprise that Federated wants to do away with the brand. Ending the speculation, Federated

announced in July that the F Street store would in fact become Macy's.

O.K. so what does Bloomies have to do with all of this? They have been shopping around, possibly downtown or Georgetown, for a new site to house a trimmed-down, boutique store. Obviously, if Hecht's became Bloomie's they would not put their boutique concept downtown. But now with Macy's about to take over, the long-dreamed return of a second department store could happen.

A downtown with two department stores would certainly speed up the reignition of the historic shopping district. If that happened the big, big loser would not be Georgetown, but Pentagon City, which depends so heavily on D.C. shoppers.

Posted by

dcbubble.blogspot

at

9:53 AM

0

comments

![]()

July 31, 2005

Is It or Isn't It?

Is It or Isn't It?

Do I think the residential market is overvalued and all homeowners will lose their shirts soon if not sooner? No. Fear and panic are almost never are the best responses to an uncertain situation. But let's face it, the market must cool. Prices have come too far, too fast not to.

Even if you are now buying at the peak (and no one knows whether you are or not until after the fact), no matter what you will be richer in ten years, if:

- your property is in a gentrifying neighborhood (i.e. U Street),

- you did not wait too long to get into the game and/or

- you did not engage in the equivalent of a nuclear bidding war when you originally bought the place.

Needless to say, the days of buying a property, flipping it after holding for 6 months and then enjoying a 20% jump are over. But that does not mean when prices come down they will drop, say, as fast as when they went up.

We are talking real estate here, not equities. Unlike stocks, which can be dumped in an instant, real property takes longer to sell because of the legalities and because it usually is occupied, possibly by you. In other words, the housing market is less volitile than more liquid market, like high-tech stocks or Dutch tulips. Bottom line, the market soon will fall slowly.

Then again I have been wrong before about the direction of d.c. housing prices. Years ago even before guru Alan Greenspan warned of an over-ripe market, I was saying prices could not go higher. Well I sure was wrong then and could be wrong now.

Any wanna buy a seven-figure one bedroom in Dupont Circle?

Posted by

dcbubble.blogspot

at

9:23 PM

2

comments

![]()

Labels: the market